The True Scale: Understanding The Size Of The Iranian Economy

Exploring the size of the Iranian economy is a complex endeavor, fraught with unique challenges and geopolitical nuances. It's not merely about crunching numbers; it's about understanding a nation's resilience, its potential, and the intricate web of factors that shape its economic landscape. For those seeking to comprehend the economic footprint of a country often in the global spotlight, a deep dive beyond superficial headlines is essential.

This article delves into the various metrics used to assess Iran's economic footprint, the historical context that has defined its trajectory, and the future outlook for this significant Middle Eastern player. We aim to provide a comprehensive, data-driven perspective for anyone seeking to grasp the true scale of Iran's economic might, adhering to principles of expertise and trustworthiness in economic analysis.

Table of Contents

- Decoding Economic Size: Key Metrics for Iran

- Historical Context: Shaping Iran's Economic Trajectory

- The Impact of Sanctions on Iran's Economic Size

- Diversification Efforts and Non-Oil Sectors

- Demographic Dividend and Human Capital

- Geopolitical Influence and Regional Trade

- Future Outlook: Scenarios for Iran's Economic Size

- Conclusion: A Resilient Economy in Flux

Decoding Economic Size: Key Metrics for Iran

When discussing the size of the Iranian economy, the primary metric that comes to mind is Gross Domestic Product (GDP). GDP represents the total monetary value of all finished goods and services produced within a country's borders in a specific time period. However, understanding Iran's economic magnitude requires looking at GDP through different lenses: nominal GDP and GDP at Purchasing Power Parity (PPP).

Nominal GDP measures the economic output using current market prices, making it susceptible to currency fluctuations and inflation. For Iran, given its volatile exchange rates and high inflation, nominal GDP figures can fluctuate wildly and might not accurately reflect the real economic activity or the purchasing power of its citizens. For instance, according to World Bank data, Iran's nominal GDP has seen significant swings, largely influenced by oil prices and sanctions. In recent years, estimates have placed Iran's nominal GDP in the range of hundreds of billions of U.S. dollars, but these figures are highly dependent on the conversion rate used for the Iranian rial.

GDP at Purchasing Power Parity (PPP), on the other hand, adjusts for differences in the cost of living and inflation rates between countries, providing a more realistic comparison of economic output and living standards. Under PPP, Iran's economy often appears significantly larger, sometimes placing it among the top 20-30 economies globally. This is because the purchasing power of the Iranian rial internally is much higher than its official or black-market exchange rate would suggest. PPP figures offer a better sense of the actual production capacity and the real wealth generated within the country, insulating the analysis from currency manipulation and external pressures.

Beyond GDP, other indicators help paint a comprehensive picture of the size of the Iranian economy. Per capita income, while often lower in nominal terms due to population size and exchange rates, provides insight into individual prosperity. Trade volume, encompassing both exports (primarily oil, gas, petrochemicals, and non-oil goods like agricultural products and minerals) and imports, indicates the economy's integration with global markets and its reliance on external trade. Industrial output, particularly in sectors like automotive, steel, and mining, showcases the diversification efforts away from pure oil dependency. The sheer scale of Iran's population, over 85 million, also implies a significant domestic market, which is a crucial factor in its economic resilience.

It's important to acknowledge the challenges in obtaining precise and consistent economic data for Iran. Sanctions, a complex multi-tiered exchange rate system, and a significant informal economy can make official statistics less reliable. International bodies like the IMF and World Bank often rely on Iranian government data, which can be subject to political considerations, or they use their own models to estimate figures, leading to variations in reported economic size.

Historical Context: Shaping Iran's Economic Trajectory

The contemporary size of the Iranian economy cannot be understood without appreciating its turbulent historical context, particularly since the 1979 Islamic Revolution. The revolution fundamentally reshaped Iran's economic structure, leading to nationalization of key industries, a shift away from Western economic models, and an emphasis on self-sufficiency.

The devastating Iran-Iraq War (1980-1988) inflicted immense damage on infrastructure and diverted vast resources towards military spending, significantly hindering economic development. Post-war reconstruction efforts were arduous, laying the groundwork for a more resilient, albeit state-dominated, economy. This period also cemented the economy's reliance on oil revenues, which became the primary source of foreign exchange and government funding.

Oil dependency has been a double-edged sword for Iran. While it has provided substantial wealth, it has also exposed the economy to the volatile swings of global oil prices, leading to boom-and-bust cycles. Periods of high oil prices allowed for increased government spending and development projects, but sharp drops often triggered economic crises, inflation, and unemployment. This volatility has historically made it challenging to maintain consistent growth and accurately gauge the long-term size of the Iranian economy.

Perhaps the most defining external factor influencing Iran's economic trajectory has been the imposition of international sanctions. These punitive measures, escalating significantly over the past two decades due to Iran's nuclear program and regional activities, have profoundly impacted every facet of the economy. They have restricted access to international financial systems, limited oil exports, deterred foreign investment, and hampered technology transfer. This prolonged period of isolation has forced Iran to develop indigenous capabilities and foster a "resistance economy," but at a considerable cost to its overall economic potential and growth.

The Impact of Sanctions on Iran's Economic Size

Sanctions have been a constant, pervasive force shaping the size of the Iranian economy for decades. Their impact is multifaceted, affecting everything from oil exports and banking to foreign investment and the daily lives of ordinary citizens. The most significant sanctions regimes, particularly those imposed by the United States and the European Union, have targeted Iran's vital oil sector, its financial institutions, and its access to global markets.

Directly, sanctions have severely curtailed Iran's ability to export oil, its main source of revenue. At its peak, Iran was exporting millions of barrels per day; under stringent sanctions, this volume has plummeted, often to a fraction of its capacity. This reduction in oil income directly shrinks the government's budget, limiting its ability to fund public services, infrastructure projects, and social welfare programs. Furthermore, banking restrictions make it incredibly difficult for Iran to conduct international transactions, even for legitimate trade, leading to a reliance on informal channels and bartering systems.

Indirectly, sanctions have fueled inflation, caused the Iranian rial to depreciate significantly against major currencies, and deterred much-needed foreign direct investment (FDI). High inflation erodes purchasing power, making goods and services more expensive for Iranians. Currency depreciation makes imports more costly and complicates business planning. The lack of FDI starves Iranian industries of capital, technology, and expertise, hindering modernization and expansion, thereby limiting the overall growth and potential size of the Iranian economy. Many international companies, fearing secondary sanctions, have withdrawn from Iran, isolating the country from global supply chains and technological advancements.

Navigating International Restrictions

Iran has developed sophisticated mechanisms to circumvent sanctions, including clandestine oil sales, using front companies, and fostering trade relationships with countries less aligned with Western sanctions policies. These methods, while allowing some level of economic activity to continue, often come with higher costs and reduced efficiency, further impacting the real economic size. The constant need to adapt to and bypass restrictions diverts resources and attention that could otherwise be used for productive economic development.

The Dual Economy: Formal vs. Informal Sectors

Sanctions have also contributed to the growth of Iran's informal economy. A significant portion of economic activity, including smuggling and black-market currency exchange, operates outside official channels. While this informal sector provides livelihoods for many and helps mitigate the impact of sanctions, it is untaxed, unregulated, and not fully captured in official GDP statistics. This makes it challenging to accurately assess the true size of the Iranian economy and the extent of its resilience, as a considerable portion of economic activity remains unmeasured.

Diversification Efforts and Non-Oil Sectors

Recognizing the inherent vulnerabilities of an oil-dependent economy, Iran has long pursued policies aimed at diversification. These efforts have gained renewed urgency under sanctions, as the government seeks to bolster non-oil exports and develop other sectors to contribute to the size of the Iranian economy.

Agriculture remains a vital sector, employing a significant portion of the workforce and contributing substantially to food security. Iran produces a wide range of agricultural products, including pistachios, saffron, fruits, and vegetables, many of which are exported. The manufacturing sector, despite challenges, has shown resilience. Iran has a robust automotive industry, producing vehicles primarily for the domestic market, and significant capabilities in steel, cement, and petrochemicals. These industries, while often operating below their full potential due to sanctions and lack of investment, represent significant components of Iran's industrial base.

The services sector, including retail, tourism (when not impacted by travel restrictions), and financial services, also contributes significantly to GDP. There has been a notable push towards developing a knowledge-based economy, leveraging Iran's large pool of educated youth. Start-ups in tech, e-commerce, and digital services have emerged, demonstrating innovative capacity despite the challenging environment. These nascent industries, while not yet on the scale of oil, represent future growth engines and are crucial for the long-term expansion of the size of the Iranian economy.

Demographic Dividend and Human Capital

One of Iran's most significant, yet often underestimated, assets is its human capital. With a population exceeding 85 million, Iran is a relatively young country with a high literacy rate and a substantial number of university graduates, particularly in engineering, medicine, and sciences. This demographic dividend presents an immense potential for economic growth and innovation, directly influencing the future size of the Iranian economy.

The large, educated workforce could drive productivity gains, foster entrepreneurship, and attract investment if the right conditions are met. Iranian engineers, scientists, and IT professionals are highly skilled, contributing to various domestic industries and, in some cases, achieving international recognition. The country's robust university system continues to produce talent, which is a foundational element for any modern economy.

However, Iran also faces the challenge of "brain drain," where many highly educated individuals seek opportunities abroad due to economic stagnation, lack of job prospects, and social restrictions at home. This outflow of talent represents a significant loss of human capital and hinders the country's ability to fully capitalize on its demographic advantage. Addressing this challenge through economic reforms, job creation, and fostering a more open environment for innovation is crucial for realizing the full potential of Iran's human resources and consequently, its economic scale.

Geopolitical Influence and Regional Trade

Iran's strategic geographical location, bordering the Caspian Sea, the Persian Gulf, and several key regional players, positions it as a potential hub for trade and transit. Its geopolitical influence in the Middle East and Central Asia is undeniable, and this influence often translates into economic opportunities and challenges, impacting the size of the Iranian economy.

Iran has actively pursued regional trade agreements and infrastructure projects, such as the International North-South Transport Corridor (INSTC), which aims to connect India, Iran, Russia, and Europe. Such initiatives could significantly boost Iran's transit revenues and integrate its economy more deeply with its neighbors. Despite sanctions, Iran maintains trade relationships with countries like China, India, Turkey, and Russia, which are often less susceptible to U.S. pressure. These relationships are vital for Iran's import needs and for finding markets for its non-oil exports.

However, Iran's regional foreign policy and its involvement in various conflicts have also led to isolation and further sanctions, hindering its ability to fully leverage its geographical advantages. Stability in the region is paramount for fostering sustained economic growth and attracting the necessary foreign investment to expand its economic footprint.

Strategic Partnerships and Economic Alliances

Iran has increasingly sought to strengthen economic ties with non-Western powers, particularly through organizations like the Shanghai Cooperation Organization (SCO) and BRICS+. Membership in such blocs offers Iran platforms for economic cooperation, trade facilitation, and potentially, a degree of insulation from Western sanctions. These alliances could open new markets for Iranian goods and services and provide alternative sources of investment and technology, thereby contributing to the expansion of the size of the Iranian economy over the long term.

The Role of the Private Sector and State-Owned Enterprises

The Iranian economy is characterized by a significant presence of state-owned enterprises (SOEs) and quasi-governmental foundations (Bonyads), which control large swathes of the economy. While the private sector exists and contributes, its growth is often hampered by competition from these powerful entities, lack of access to finance, and bureaucratic hurdles. For the size of the Iranian economy to truly flourish, a greater role for the private sector, coupled with transparent regulations and a level playing field, is essential to unleash entrepreneurial spirit and efficiency.

Future Outlook: Scenarios for Iran's Economic Size

The future size of the Iranian economy hinges on a confluence of internal reforms and external geopolitical developments. Several scenarios could unfold, each with distinct implications for its economic trajectory.

One optimistic scenario involves a significant easing or lifting of international sanctions. This would immediately boost oil exports, increase foreign exchange reserves, and likely lead to a surge in foreign investment. Access to international banking would normalize, facilitating trade and reducing the costs of doing business. Under such conditions, Iran's economy could experience rapid growth, leveraging its vast natural resources, educated workforce, and large domestic market. This would allow for much-needed modernization of infrastructure, industries, and the energy sector, expanding its overall economic magnitude.

Conversely, a scenario of continued or even escalated sanctions would perpetuate the current challenges. The economy would remain constrained, relying heavily on resilience and informal mechanisms. Growth would likely be modest, if any, with persistent inflation and unemployment. In this situation, the government would continue to prioritize self-sufficiency, potentially leading to further isolation from global economic trends and technological advancements, limiting the potential size of the Iranian economy for years to come.

Regardless of the sanctions regime, internal structural reforms are crucial. These include diversifying the economy away from oil, privatizing state-owned enterprises, improving the business environment, combating corruption, and attracting domestic and foreign investment into non-oil sectors. Investing in human capital, particularly in innovation and technology, and addressing the brain drain would also be vital for sustainable growth. The ability of the Iranian government to implement these reforms effectively will be a key determinant of its long-term economic prosperity and its position on the global economic stage.

Conclusion: A Resilient Economy in Flux

The size of the Iranian economy is a dynamic and multifaceted concept, shaped by its rich history, abundant natural resources, resilient population, and complex geopolitical landscape. While often underestimated due to external pressures and data complexities, Iran possesses significant underlying economic potential, particularly in its large domestic market, diverse non-oil sectors, and highly educated workforce.

Measuring Iran's economic magnitude requires looking beyond simple nominal GDP figures, delving into PPP comparisons, and understanding the profound impact of sanctions. The nation's ongoing efforts to diversify its economy, foster strategic regional alliances, and develop its human capital underscore a deep-seated drive for economic resilience. However, persistent challenges such as inflation, unemployment, and the need for comprehensive structural reforms mean that the path to realizing its full economic potential remains complex.

As Iran navigates its future, the interplay between its internal policies and external relations will continue to define its economic trajectory. Understanding this intricate balance is crucial for anyone interested in the economic landscape of the Middle East and the broader global economy. We encourage readers to delve deeper into the data provided by reputable organizations like the World Bank and the International Monetary Fund to gain further insights. What are your thoughts on the future trajectory of Iran's economy? Share your perspectives in the comments below, or explore our other articles on regional economic developments.

- Finn Wittrock Movies And Tv Shows

- Spencer James

- Megan Follows

- Shacarri Richardson

- Kellie Shanygne Williams

Size Chart Template With Measurements Of Men's Shoes - Mediamodifier

Size Guide – ForMe

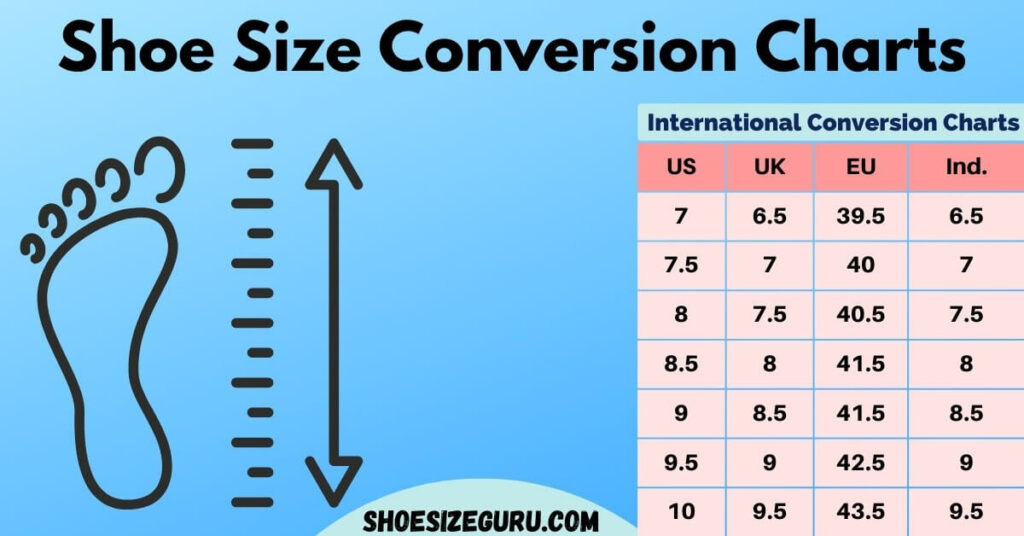

International Shoe Size Conversion Charts » US | UK | EURO